Balancing FI with Family Life: When More Savings Means Less Time

Financial Independence (FI) is often presented like clean math—spend less, save more, invest—and you’re done. Real life is messier. If you’re raising kids, supporting aging parents, or living in a high cost-of-living area, every extra percent into a 401(k) might help future-you but squeeze present-you. Sometimes, saving more means sacrificing time—time with your family, time for yourself, time to simply live.

This post looks at the trade-offs and shows how a quick pass with our Take-Home Pay Calculator can help you choose a contribution level that fits your actual life.

The Real-Life Dilemma

Maxing accounts moves you toward FI. But if it leaves you tight on monthly cash flow, you may delay trips, activities, or childcare help that matter right now. The goal of FI is freedom; if your plan makes life feel smaller for years on end, it may be time to adjust.

Seeing the Trade-Offs Clearly

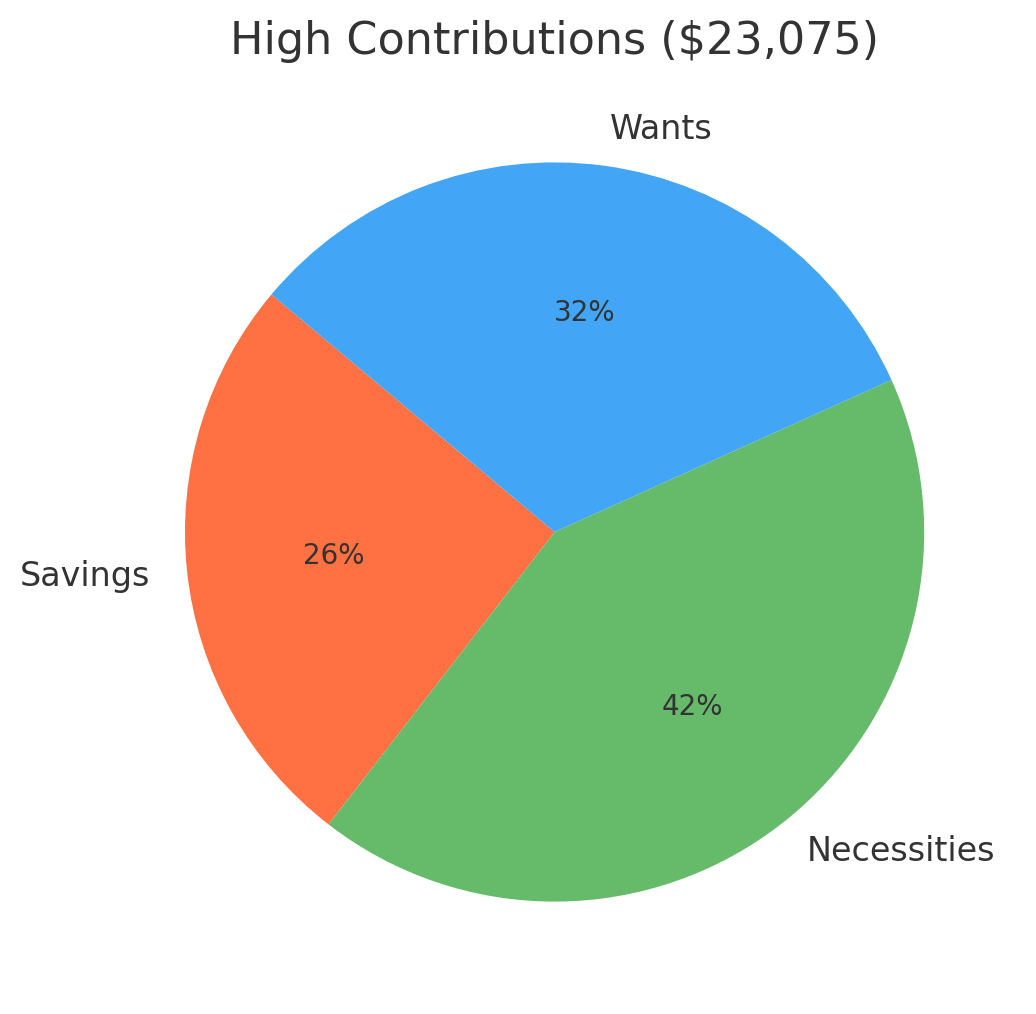

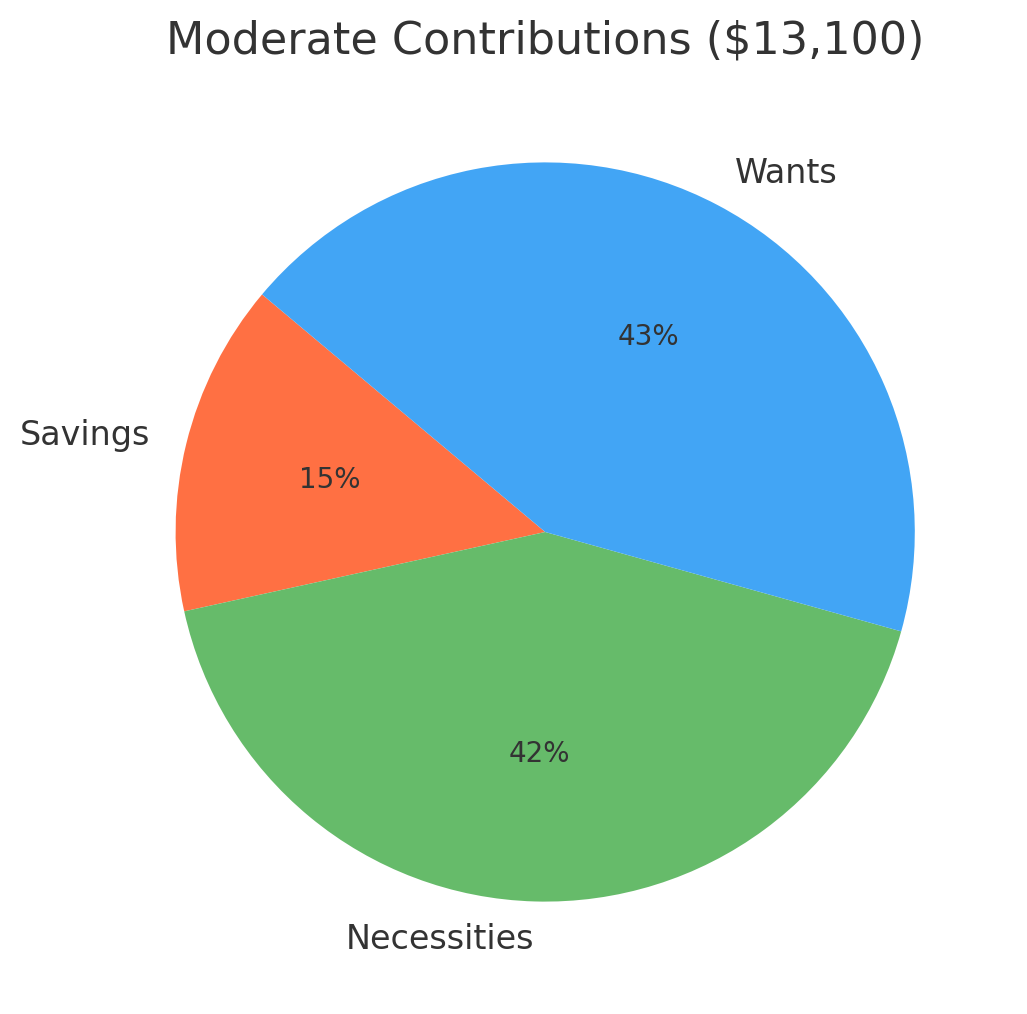

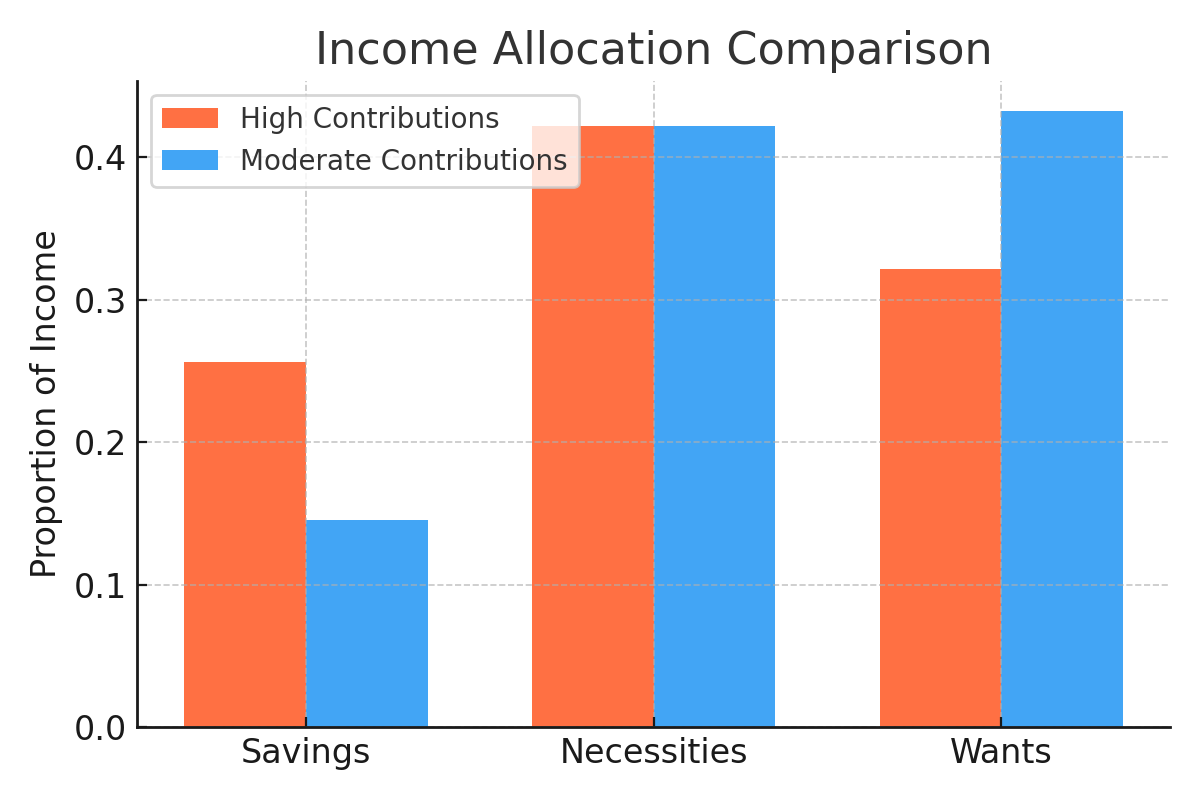

Same income, two contribution strategies. One prioritizes higher pre-tax savings; the other leaves more breathing room in today’s budget.

Time as a Currency

Money compounds, but so do moments. Before bumping contributions, ask: Will this meaningfully accelerate my FI date, or mostly reduce my quality of life this year? There’s a middle lane where you still progress toward FI while funding what matters now.

The Takeaway

FI isn’t deprivation; it’s design. Run scenarios, adjust, repeat. And remember: the “optimal” spreadsheet answer isn’t always the optimal life answer.

Want to test your own numbers? Try the free Take-Home Pay Calculator and see how contribution changes affect your cash flow.